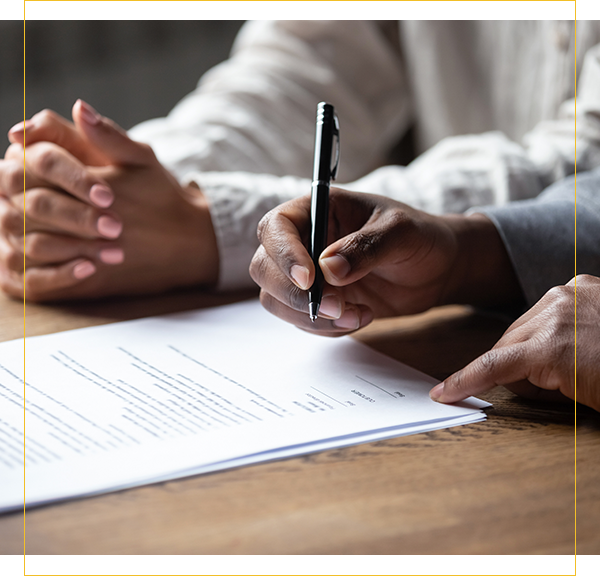

An experienced trust lawyer can help you understand your trust options and structure a trust program that will serve your goals and needs. A knowledgeable trust attorney can also ensure that your trust documents are correctly crafted so that they are valid, legally enforceable and adequately protect your wealth for your family.

If you and your family are considering a trust as part of your estate plan, contact us at Business Estate & Tax Attorneys, P.C., to schedule a confidential initial case evaluation to discuss your estate planning goals.

What Is a Trust?

A trust is a legal instrument that creates a type of fiduciary relationship. The person creating the trust is known as a settlor, grantor or trustor. That person gives another party, known as the trustee, title to property or assets for the benefit of another party, known as a beneficiary.

The trustee manages the trust assets in accordance with the terms and provisions set forth in the document that created the trust. Trusts are typically used as part of an individual’s or family’s estate plan. Trusts can also be established as a type of business organization (in which case they are called business trusts).